Advanced Mean-Variance Analysis Techniques for Professional Investors

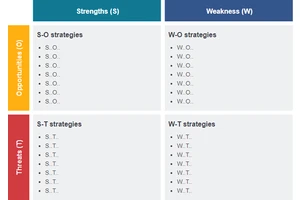

The art of portfolio management has evolved far beyond simple diversification. Today, advanced mean-variance analysis techniques

Article Details

The art of portfolio management has evolved far beyond simple diversification. Today, advanced mean-variance analysis techniques

Article Details

In today’s complex financial markets, idiosyncratic risk—also known as asset-specific or unsystematic risk—plays a critical role in portfolio

Article Details

In modern financial markets, default risk management is no longer a concern solely for banks or large institutions—it is also a critical factor for

Article Details

=== Introduction Perpetual futures have become a cornerstone of modern trading, particularly in cryptocurrency and derivatives markets.

Article Details

Introduction In the world of perpetual futures trading , understanding and applying advanced beta techniques is crucial for

Article Details

Introduction In the world of quantitative analysis and algorithmic trading, achieving alpha —or excess returns above the market benchmark—is the holy

Article Details

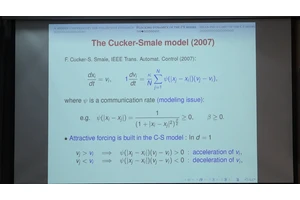

= Mean-variance analysis, first introduced by Harry Markowitz in the 1950s, remains one of the most influential frameworks in portfolio

Article Details

Perpetual futures have become one of the most actively traded derivatives in the cryptocurrency market. Their popularity stems from

Article Details

Arbitrage pricing in perpetual futures is an essential concept for traders and investors looking to capitalize on market

Article Details

Arbitrage pricing in perpetual futures trading is a key strategy for investors and traders looking to exploit market inefficiencies.

Article Details